A reader of this blog posted the following comment:

What about 2007, 2008, 2009, and 2010 for that matter.... As taxpayers we should see it all and there should be an audit every year to balance the books or the very least every 2 when we switch the Supervisor from Democrat to Republican... yes 2006 was a point of tension but this has been going on for years, I guarantee it... BRING IT ALL OUT!!!

I wholeheartedly agree that the books need to be examined and audited at least every two years to identify any discprencies in the town's financial records.

To answer this comment, there was NO audit performed for the years 2007 and 2008. From the comments made by the former supervisor, Pompey Delafield (that are on record in Town Board meetings which are available online) it can be deduced that there was an overall denial that were discrepencies and errors made in the financial records of the town. As to the reasons why there was a denial is unknown, however there are speculations why the bookkeeper was not subject to discplinary action for keeping inaccurate records.

Further research in regards to whether or not audits were done for fiscal years prior to 2006 needs to be done.

The audit for 2009 is currently in progress and according to sources, there was a draft that was completed and sent to the supervisor. The final and official report should be due out shortly.

I would like to thank the reader by the name of 'Peter Pan' who may also go by the aka Tinkerbell, aka Mickey Mouse for bringing to my attention the following information. As they stated, Comment: Okay...lets see. The first one is the COMPTROLLER JOB DESCRIPTION as per Dutchess County Personnel. Does this agree to your interpretation?

The second is Town Law - by LAW job duty of the Comptroller. Has this or any Comptroller appointed by Martino SATISFIED the law requirements?

I would like to note that this particular reader has made it well known that they feel that Ms. Joanne Lown is qualified for the dissolved position of bookkeeper and created position of comptroller. The findings of the 2006 audit report can dispute those claims as they recommended additional supervision of this individual by the supervisor as well as having to correct $320,455 in liabilities that were not recorded correctly. A Dutchess County Supreme Court Judge also agreed with the Town's decision to eliminate the position of bookkeeper based upon the business model. Not based upon the best interests for Ms. Lown. Ms. Lown's salary that was reported in 2010 was over $50,000, of which was essentially was funded from tax dollars. Ms. Lown was not held accountable for the errors she made (nd denied mking) and continuted to make by the past administrations. Unfortunately the record of the errors and findings are printed in black and white so it is quite difficult to dismiss them as being 'lies.' Unless of course, taken from the script from Conspiracy Theory, there is a

One burning question remains. In the private sector, would an individual still remain employed if they made errors totaling $320,455 in the reporting of the company's finances? Obviously this reader does not realize that Ms. Lown does not have experience working in the private sector (in the private sector job security is largely based upon job performance) because they believe that she (Ms. Lown) is entitled to this job rather than the performance and merit. This statement can not only be based upon the lawsuit that she filed and lost, but also on her faithful attendence at the Town Board meetings in which she regularly comments on her opinion that she is qualified to be a Comptroller.

Further elaborating on the above statement, while the loss of employment can be devastating at the time, the majority of those who find themselves unemployed are able to move forward, whether it be returning to school or obtaining new employment. From the comments that were posted by Mickey Mouse, aka Peter Pan, aka Tinkerbell, the bitterness that is emitted from their comments is obvious and unfortunately, no matter what the auditors report, the number of errors that were found or the amount of those errors, they will never believe and admit to that they possibly erred.

1. Comment: COMPTROLLER

DISTINGUISHING FEATURES OF THE CLASS:

This is an exempt class position responsible for the general superintendence of the fiscal affairs of a municipality. The incumbent works under the administrative supervision of the governing body of a municipality who reviews work for conformance to the law and policy.

TYPICAL WORK ACTIVITIES:

1. Maintains records of appropriations, encumbrances, and expenditures, and prescribes approved methods of accounting for all units of local government;

2. Certifies the availability of funds for all requisitions, contracts, purchase orders and other documents for which the municipality incurs financial obligations;

3. Prescribes the form of receipts, vouchers, bills and claims otherwise prescribed by the State Comptroller;

4. Audits and certifies for payment all lawful claims or charges;

5. Audits the financial records and accounts of all units of the government;

6. Submits reports to the governing body;

7. Has all the powers and performs all the duties conferred or imposed by law;

8. Does related work as required.

FULL PERFORMANCE KNOWLEDGE, SKILLS, ABILITIES AND PERSONAL CHARACTERISTICS:

Good knowledge of financing, major economic objectives and policies; good knowledge of budget preparation and financial forecasts; knowledge of operational adjustments due to tax revisions; knowledge of insurance coverage and protection against property losses and potential liabilities; physical condition commensurate with the demands of the position.

RECOMMENDED TRAINING AND EXPERIENCE:

Three (3) years of accounting or auditing experience, one (1) of which shall have been in a responsible capacity and graduation from a college or university recognized by the State University of New York with major work in accounting or business administration; or five (5) years of progressively responsible experience in accounting or auditing work and graduation from a standard senior high school; or any satisfactory equivalent combination of experience and training sufficient to indicate ability to do the work.

2. Comment: B. Record and reporting requirements.

(1) The town comptroller as accounting officer shall:

(a) Keep detailed accounting records.

(b) Render a detailed monthly report to the town board of all receipts and

disbursements and file a copy in the town clerk's office.

(c) Prepare and file with the town clerk by January 31 each year an annual financial

report of the monies received and disbursed, with bank certifications showing the amount

of money on deposit; and shall publish a copy of the report in the official newspaper.

(2) In lieu of preparing the report as described above, within 60 days after the close of

the fiscal year, the town comptroller may file with the town clerk a copy of the annual

financial report to the State Comptroller.

(3) Within 10 days after receipt thereof, the town clerk shall publish in the official

newspaper and in such other newspapers as the town board may direct, either a summary

of such report or a notice that the report is available in the town clerk's office for public

inspection and copying [Town Law § 29(10-a)].

C. Additional responsibilities. In addition to the above, the town board may also

provide (by ordinance or local law) that either or both of the following powers and duties

of the supervisor shall devolve upon the town comptroller:

(1) Keeping appropriation accounts and preventing overdrafts;

(2) Drawing upon funds and appropriations, provided checks are countersigned by the

supervisor.

D. Town Law § 34(2) provides that the "town comptroller shall furnish the

supervisor with such information and data as the supervisor may require for the purpose

of enabling him to exercise his powers and perform his duties or make reports required by

Now that the auditor's findings of the 2006 fiscal year are posted (PLEASE SEE THE BELOW POSTED BLOG), let's take a look at some of the comments that were made at past Town Board meetings:

Here are some of the comments:

Jan. 24, 2011

Joanne Lown, Horns Park Rd., questioned why the Town was hiringSpecial Counsel for the Board of Ethics and the temporary clerk in Administration.

Supervisor Martino explained that the Board of Ethics requested Special Counsel for an issue before them and that a part time clerk was needed to help catch up on work since the loss of the Senior Account Clerk.

Joanne Lown stated that the Procurement Policy was not being updated and that bills are being paid illegally from incorrect funds. Um, hate to break the news, but your not the bookkeeper anymore Joanne.

Patricia Dreveny, 611 Violet Ave., asked how the new Comptroller will make the town finances better. She also questioned why the highway bills were not being paid.

Bob Arata, Ledgewood Drive, read a letter against hiring a Comptroller.

The following is the job description and educational requirements of a comptroller (this is a general description so there may be additional/less responsiblities., so I have no idea why one would be against it, unless he has some personal bias against Comptrollers in general...

Job Description of a Comptroller

The scope of duties of a comptroller, includes financial, accounting and administrative related work. The reporting head of the comptroller is the senior administrative officer or manager. So here's a brief information on comptroller job description. - Establishing and maintaining cash controls and reconciling of general ledgers and bank statements.

- Provide assistance to the senior authorities in preparing the annual budget and also the annual audit.

- Maintaining the purchase order system.

- Adhering and implementing the financial procedures and policies, set by the higher management.

- Supervising investments and cash reserves.

- Monitor data entry systems and procedures.

- Prepare and systematically maintaining all the supplier accounts.

- Verifying charges and ensuring security of all credit cards.

- Preparing income statements and also keeping tabs of transactions and their entry in the computerized accounting database.

- Classifying and maintaining financial files and records, according to the year.

- Working on the preparation of quarterly reports, monthly financial statements and balance sheets.

- Reconciling the payable accounts, receivable accounts and preparing journal summaries.

- Issuing receipts for all the accounting transactions.

- Maintaining records pertaining to the financial systems.

- Issuing, coding and authorizing purchase orders.

- Compiling source documents.

- Reconciling source deposits.

- Office management duties of the comptroller include, the maintenance of filing systems, security systems of documents, maintaining insurance coverages, responding to customer and employee queries.

- The administrative work involves, employee management duties such as, reviewing payroll reports, receiving employee work reports from other departments and calculating their salaries, contributions and deductions (if any!).

- Processing and distributing pay checks.

- Maintaining and ensuring proper updating of the leave system.

- Making adjustments to the payroll wherever necessary.

- Ensuring the proper documentation of the records and documents of the new employees in the accounting system.

- Looking after the administration of benefit entitlements.

- Verifying and reporting on benefit payments.

With the above information on comptroller job description, you must have understood that comptrollers are amongst the key members of the organization. So now let us move ahead to know about the educational requirements and salary range of the same.

Comptroller Educational Requirements

The comptroller's job is not an easy one! Rather, comptrollers are highly responsible people, looking after the accounts, finance and administration tasks of the organization. The position therefore needs a well educated and qualified personnel. To seek job as a comptroller, a bachelor's degree in accounting is necessary. Some organizations might demand a master's degree in finance or accounting. However, it depends upon the organization and the scope of work. Apart from this, thorough knowledge of the latest accounting softwares, financial softwares, management systems, payroll procedures, knowledge of verifying and interpreting financial data and records, excellent communication skills to coordinate with the employees and management personnel of other department, are also essential for the position of a comptroller.

He wants to see the former Bookkeeper reinstated rather than a Comptroller, stating that the former Bookkeeper only made one mistake in twenty three years. He would like to see a Town Manager and not a Supervisor.

Actually she made more than just one which was the 3/4 million dollar one. She didn't pay the ambulance service for Quaker Road for several years. Then I heard there was a $35,000 Forest Drive landfill error. Oh, and she wasn't maintaing the records accurately from what was discovered...

Joanne Lown, Horns Park Road, stated her qualifications to become a Comptroller. She feels that there is not proper financial reporting in the town.

You need to have more than a two year college degree from Dutchess Community College in order to be qualified as a Comptroller as well as the ability to maintain proper records (see above job description and the auditor's report that is posted on this site) Being in a position for eleven years doesn't necessarily mean that you are qualified for the job, it just means that you were able to do alot of skating.

Pompey Delafield, 62 E. Market St., feels that it was a mistake to abolish the Bookkeeper position.

Really Pompey? Did you even read the auditor's report?

He also feels that the new Conservation Advisory Council members do not have the experience necessary.

Councilman Taylor stated that the new Comptroller has municipal experience.

Supervisor Martino presented three pages of exceptions from the 2009 Audit.

June 13, 2011

Joanne Lown, Horns Park Road, questioned the balance of the fund balance and the status of the police budget. .

Councilwoman Serino stated that she did not know what the General Fund Balance was.

From what I've read in the minutes of the Town Board meetings. Sue Serino doesn't really know much of anything in regards to the Town.

Supervisor Martino stated that the town was currently undergoing an audit of the year 2009. He stated that the auditors have found that ending balances do not agree with the beginning balances of the next year and that certain bank reconciliations within the system had not been done for 11 years. These are the reasons that requested reports are not available at this time. Auditors are trying to complete the records. 2007 audit issues that had not been addressed in the past, but are now being addressed.

I can conclude that the results of the 2009 audit are parallel with the findings of the 2006 audit. Apparently the corrections that were recommended to be made in the previous audit were not done based upon what Mr. Martino has said.

Joanne Lown stated that bank reconciliation had been done and feels that end year reports should be available.

If the 2009 audit reflects the findings of the 2006 audit, I highly doubt her claim.

Councilwoman Serino asked when the audit would be done. Although she supports Chief Broe she wants the audit completed before he receives a salary increase.

Maybe Ms. Serino shouldn't have voted against having an audit perfomed (see Sue Serino, HV News Sweetheart blog for her voting record)

Councilman Taylor again stated that the funds for the Police Chief salary increase would be coming from monies that are already appropriated in thebudget. He feels that we need a full time Police Chief.

Joe Petito, Cobey Terrace, questioned how the Town could function if they did not know how much money was left in the Police budget.

Aileen Rohr, 53 Fuller Lane, asked if because the Town was having an audit, that meant that you could not do a year end financial statement.

Attorney to the Town James Horan stated that the 2009 balance between the bank account and the computer does not match and that errors made in 2006 regarding the landfill, have not yet been explained. They are trying to reconcile these issues.

Below are a few of the pages from the auditor's report of the fiscal year 2006. The report is 38 pages total and I couldn't possibly post all of the pages on this blog, but I would like to stress that this information can be obtained through the Town Clerk thanks to the Freedom of Information Act.

Let's take a look at the some important points.

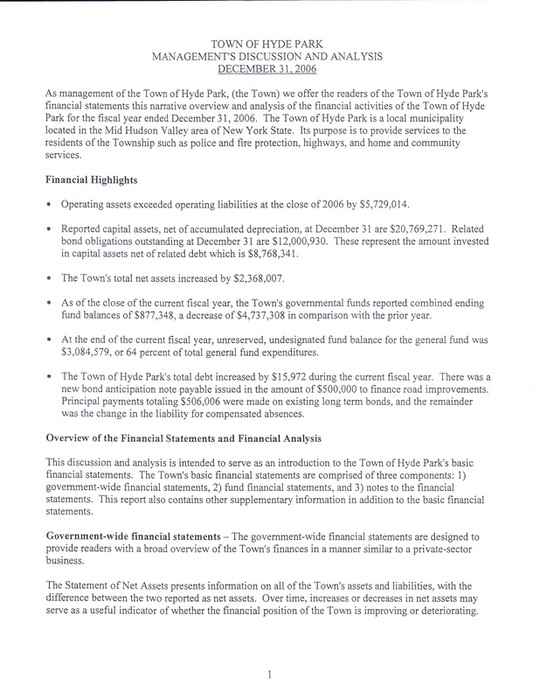

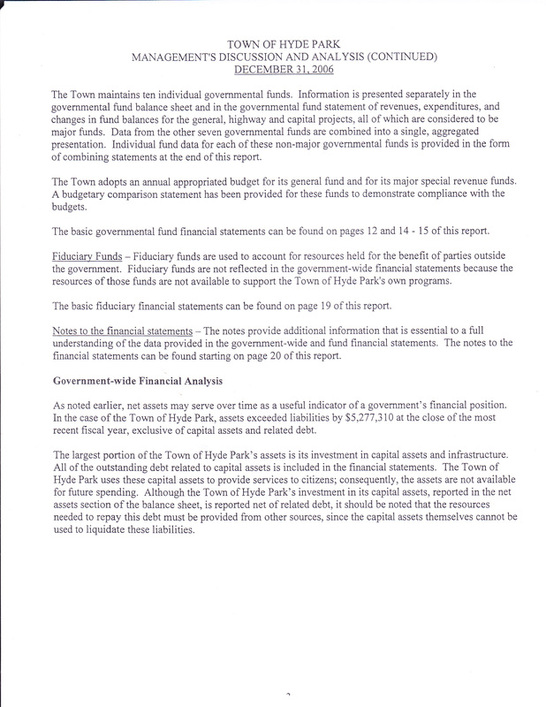

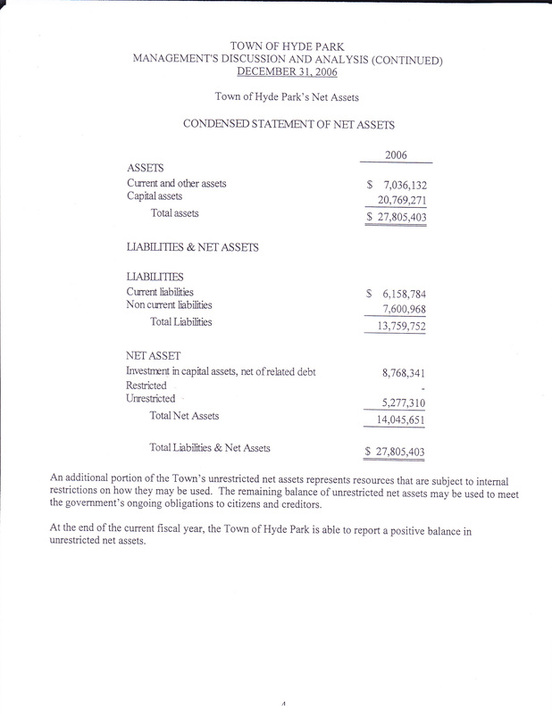

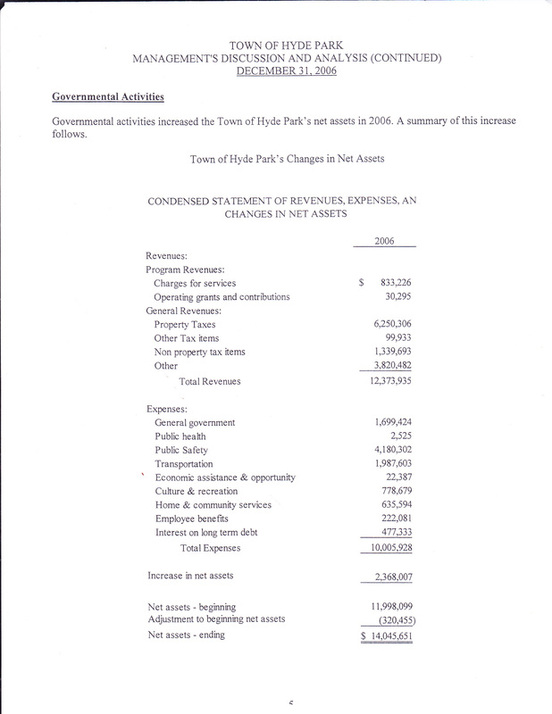

1) On page six (6), it states the fund balance was $877, 348. A decrease by $4,737,308 due to several factors, including a decrease in property tax, an increase in spending, and the debt proceeds received from the year before.

I recall that several people, including Aileen Rohr were so concerned that the current balance was under one million dollars. Where they concerned in 2006 as well?

2) On page twenty (20), a description of the town includes the duties of the Supervisor, whom serves as the chief executive officer as well as the chief financial officer. With that being the case, is Joseph Kakish competent to serve as the CFO given the HISTORY OF JUDGMENTS ON FILE OF OVER $100,000 that both him and his wife accured in the past ten years?

3) This next figure is a real doozy. On page thirty-four (34), the auditors state that they had to make an adjustment in the amount of $320, 455 because the prior year's liabilites were not recorded in the prior period as well as the adjustments to beginning balances for capital assets. In a nutshell, Ms. Lown wasn't recording the liabilites of the town correctly.

4) On page thirty-seven (37)

a. payroll records were not being reviewed by a second person.

b. vouchers were not being processed according to policy.

c. purchase order policy was not being followed. Purchase orders were were completed AFTER the purchase had been made.

d. Bank reconciliations were not being reviewed. NOTE: the audit report stated 'the reconciliation are being prepared by the bookkeeper but there is no review by a second person. Review of these reconciliations would protect against errors and verity that the ledger balance agreed with the reconciled balance. The final result is more reliable financial reporting.'

The jist of it: The auditors are tactfully indicating that Ms. Lown was making mistakes. If she kept the accurate records as she has so claimed, there would be not need for 'more reliable financial reporting.'

e. Highway department vouchers and invoices were not being processed correctly. Mr. Doyle was making improper purchases, which may or may not be the auditor's way of saying he was items for his own personal use with the town's money. Seems to me that Mr. Walter Doyle was the Highway Superintendent in 2006. The same Walt Doyle that was featured on the cover of the HV News for berating the Town Board about some bills that were unpaid and accusing the Towm Board of being liars. The 2009 budget supposedly has the same findings, but when it will be made public then it will be confirmed if that is the case.

So there you have it. Happy Reading!

|

RSS Feed

RSS Feed